US-China Tariff Truce: Breaking Down the Geneva Agreement and Its Global Impact

Discover the inside story of the US-China tariff truce: tariff cuts, stock rallies, and what it means for global trade. Expert analysis, market impacts, and future predictions.

The US and China, the world’s economic titans, have reached a landmark agreement to slash tariffs after months of escalating trade hostilities. The Geneva talks, held on May 10–11, 2025, marked a turning point in a trade war that began with President Trump’s aggressive 145% tariffs on Chinese goods and China’s retaliatory 125% levies. This article unpacks the deal’s details, its immediate market reactions, and what it means for consumers, businesses, and global stability.

Highlighting trade bottlenecks and pre-deal shipping chaos.

The Geneva Agreement: What’s Inside?

- Tariff Reductions: While specifics remain under wraps, US officials hinted at lowering tariffs from 145% to 80%, aligning with Trump’s earlier social media suggestion. China reciprocated by pledging to ease its 125% tariffs, though exact figures await Monday’s joint statement.

- Consultation Mechanism: A new platform for ongoing dialogue aims to prevent future escalations. This includes regular economic talks and a framework to address grievances, mirroring past US-China working groups.

- Market Access: Trump’s demand for China to “open up” to US businesses remains central. While vague, this could mean easing restrictions on sectors like tech and agriculture.

Post-announcement market optimism for finance sections.

Why It Matters:

The tariffs had frozen $600 billion in bilateral trade, slashed Chinese exports to the US by 21% in April 2025, and triggered factory slowdowns in China. Even an 80% tariff might not revive trade fully—economists argue 50% is the “make-or-break” threshold.

The US-China tariff truce offers hope for strained supply chains and weary consumers, but skepticism lingers. While stock markets cheer, businesses face months of uncertainty. The real test? Turning diplomatic wins into tangible economic relief.

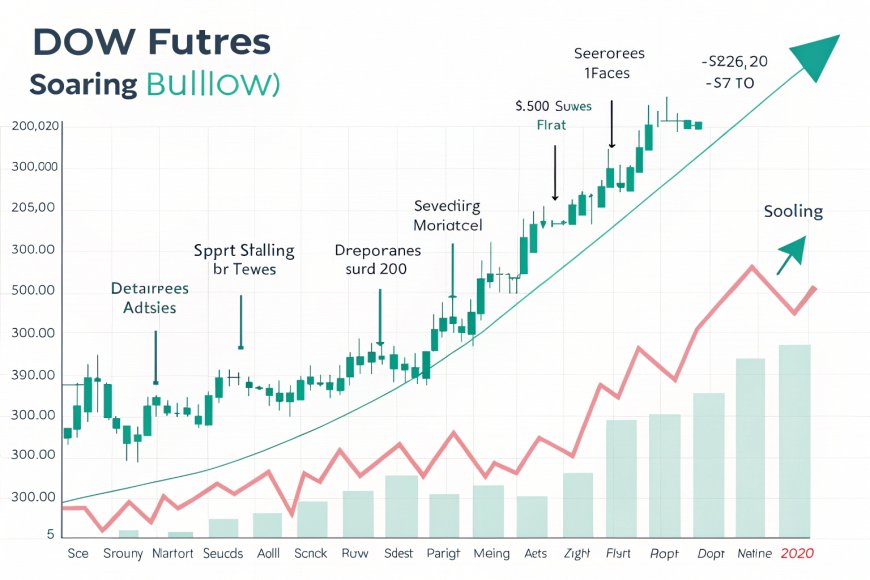

Stock Market Euphoria: A Temporary High?

The announcement sent Dow futures soaring by 1.10%, S&P 500 by 1.25%, and Nasdaq by 1.44%. Investors celebrated the thaw, but experts warn:

- Short-Term Relief ≠ Long-Term Stability: Reduced tariffs won’t immediately restock shelves or lower prices. Ships already en route under 145% duties will keep consumer costs high for weeks.

- Inflation Concerns: Goldman Sachs predicts annual inflation could hit 4% due to supply chain snarls. Cheaper tariffs might ease this, but recovery hinges on faster port clearances and factory resumptions.

Consumer impact of tariff-driven shortages.

The Human Cost: Empty Shelves and Job Losses

- Consumers: US imports from China are projected to drop 75–80% by late 2025, risking shortages in electronics, apparel, and baby goods.

- Workers: Dockworkers and truckers face layoffs as trade volumes plummet. Commerce Secretary Howard Lutnick downplayed this as a “China-specific problem,” but logistics CEOs warn of broader fallout.

- Global Ripples: The EU and emerging markets brace for redirected trade flows. Switzerland, hosting the talks, gains diplomatic clout as a neutral mediator.

Diplomatic setting of the historic talks.

Skepticism vs. Optimism: Expert Takes

- Pro-Deal Camp: Treasury Secretary Scott Bessent called the talks “productive,” while China’s Vice Premier He Lifeng praised the “important consensus”. Kevin Hassett, Trump’s economic adviser, claims 24 more trade deals are brewing.

- Critics: Analysts like Gary Hufbauer (Peterson Institute) doubt a return to normalcy, noting even 70–80% tariffs could halve bilateral trade. Others warn the deal lacks enforcement teeth, risking repeat escalations.

Visualizing inflationary risks post-tariff cuts.

What’s Next?

- Monday’s Statement: Details on tariff timelines, sector-specific agreements, and the consultation mechanism will shape market reactions.

- 2026 and Beyond: Bessent admits full normalization could take 2–3 years. Meanwhile, the US eyes similar deals with the UK, India, and the EU.

The Geneva deal marks a ceasefire, not peace, in the US-China trade war. Its success hinges on execution, global cooperation, and averting inflationary shocks. For now, the world watches—and waits.

What's Your Reaction?