AMD Stock Prediction: Can This Tech Giant Double Its Valuation by 2026?

Explore AMD’s explosive growth potential in AI, semiconductors, and tech innovation. Will its stock surge 111% by 2026? Dive into expert predictions, risks, and why investors are bullish.

Why AMD Is the Talk of Wall Street

Advanced Micro Devices (AMD) isn’t just another chipmaker—it’s a disruptor reshaping the tech landscape. With AI, gaming, and data centers driving demand, analysts are buzzing about AMD’s potential to double its valuation by 2026. But is this optimism justified? Let’s unpack the hype, the risks, and why your portfolio might need a slice of this silicon pie.

AMD stock growth vs rivals

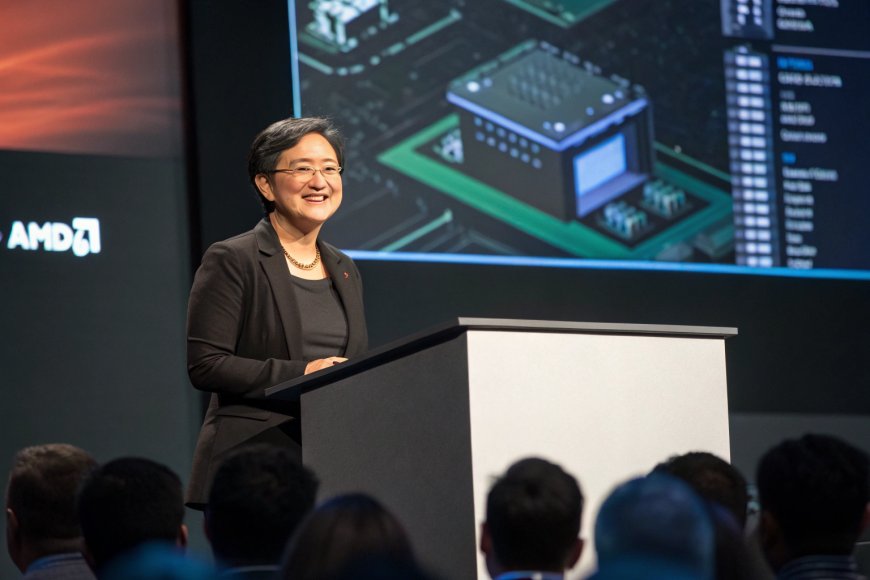

The AI Gold Rush: AMD’s Secret Weapon

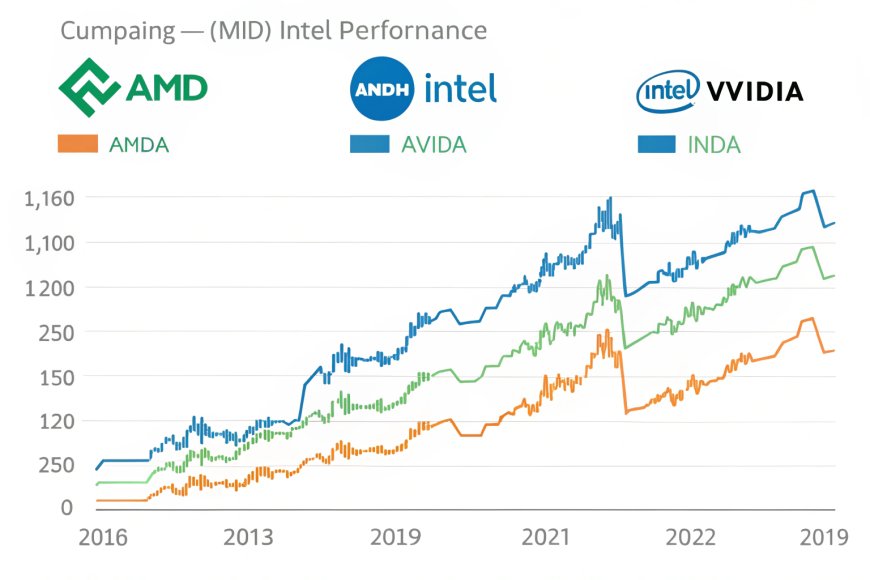

Artificial intelligence isn’t just a buzzword—it’s a $1.3 trillion opportunity, and AMD is positioning itself as a key player. While Nvidia dominates headlines, AMD’s MI300X accelerators are quietly stealing the spotlight. These chips, designed for AI workloads, are already being tested by Microsoft and Meta. If adoption scales, AMD could carve out a 20% market share in AI chips by 2025, per Morgan Stanley.

AMD CEO Lisa Su leading AI innovation

Why it matters:

- AI data centers require 5x more processing power by 2030.

- AMD’s partnerships with Amazon AWS and Google Cloud give it a moat.

- CEO Lisa Su’s aggressive R&D strategy ($5B invested in 2023 alone).

AMD’s trajectory hinges on AI adoption, supply chain stability, and out-innovating rivals. While risks loom, its tech leadership and Lisa Su’s vision make it a compelling bet. Investors should watch Q3 earnings (Oct 2024) for clues.

Semiconductor Supremacy: AMD vs. Intel vs. Nvidia

The chip war is heating up. Intel struggles with production delays, while Nvidia’s GPUs face supply crunches. AMD, however, is leveraging TSMC’s cutting-edge 3nm technology to outpace rivals. Its Ryzen CPUs now control 30% of the desktop market, up from 18% in 2020.

AMD-powered data centers fueling AI growth

Key stats:

- Data center revenue grew 38% YoY in Q1 2024.

- GPU sales for gaming rigs hit $2.1B last quarter.

- 45% gross margins—up from 32% in 2019.

The Bull Case: 111% Surge by 2026?

Cathie Wood’s ARK Invest predicts AMD could hit $400/share by 2026, driven by AI and cloud computing. Here’s the math:

- AI Chip Demand: 50B market by 2025; AMD captures 157.5B revenue.

- Data Center Growth: Projected 25% CAGR through 2026.

- Consoles & Gaming: PlayStation 6 and Xbox Series X refreshes due in 2025.

AMD GPUs revolutionizing gaming performance

Risks to consider:

- U.S.-China trade tensions could disrupt supply chains.

- Rising interest rates may slow tech spending.

- Valuation concerns: AMD trades at 35x earnings vs. industry average of 25x.

Why Retail Investors Are Flocking to AMD

Reddit’s r/stocks and r/investing are buzzing with AMD threads. Why?

- Democratization of Tech: Retail traders understand chips better than crypto.

- Lisa Su’s Rockstar Status: Her TED Talk on AI has 5M+ views.

- Options Frenzy: Call options for Jan 2025 surged 200% last month.

Advanced semiconductor manufacturing for AMD chips

The Bear Argument: Overhyped or Overvalued?

Short-sellers warn AMD’s stock is priced for perfection. Concerns include:

- Inventory Glut: PC sales dipped 8% in 2023; unsold Ryzen chips could hurt margins.

- China Slowdown: 22% of revenue comes from China (post-tariff risks).

- Regulation: EU antitrust probes into chip pricing.

AMD’s blend of AI innovation, strategic partnerships, and leadership makes it a high-risk, high-reward play. While doubling its valuation isn’t guaranteed, the tech tailwinds are too strong to ignore. Stay informed, stay agile.

What's Your Reaction?